Binarysoft is Authorised Tally Sales & Implementation Partner in India

+91 742 877 9101 or E-mail: tally@binarysoft.com

Office Hours 10:00 am – 6: 00 pm , Mon-Fri

Binarysoft is Authorised Tally Sales & Implementation Partner in India

+91 742 877 9101 or E-mail: tally@binarysoft.com

Office Hours 10:00 am – 6: 00 pm , Mon-Fri

Published on: 02-06-2023

The implementation of the GST tax in India was a significant reform in the Indian taxation system, and it has had a major impact on the Indian economy. The main focus in India has been on promoting economic growth and creating a more transparent and accountable tax regime. To achieve this, the GST council has taken various steps over the years, including the implementation of E-waybill, e-invoice, and various reforms in GST returns. However, businesses have faced multiple challenges while complying with GST rules. One of these challenges is managing GST returns for multiple branches spread across multiple states.

Some of the challenges that businesses with multiple branches face include:

A business with branches in different states of India may wish to manage its state-specific GST compliances centrally, based on their respective GSTINs.

Record Multi GSTIN transactions (GST registered multiple states or branches) at one place

Flexibility to generate GST returns, E-waybill & e-invoice instantly for all GSTINs or multiple states/branches at once and get access to comprehensive reports.

Quick access to consolidated financial statements and other MIS reports, such as balance sheets, profit and loss statements, and Trial Balance etc., for multiple states or branches within a single company

The organization wants its users to be able to view only reports pertaining to their specific GSTINs or branches and also wants to allow its users to record transactions only for their particular GSTIN/branch.

Consolidated outstanding can be viewed, in case branches are dealing with a common party.

To overcome this challenges, Tally Solutions, Tally Prime Release 3.0 has come up with Multi GSTIN which allows businesses to handle multiple GSTINs (Goods and Services Tax Identification Numbers) for different states within the same company. With Tally Prime 3.0, businesses can now easily configure and manage GST for different states and can manage their transactions, generate invoices, and file GST returns for each GSTIN seamlessly, saving time and improving accuracy.

Overall, Tally Prime's 3.0, Multi-GSTIN feature is designed to simplify the compliance process for businesses with multiple GSTINs.

Let's examine each challenge and the solutions provided for Multi GSTIN in Tally Prime Release 3.0.

A business with branches in different states of India may wish to manage its state-specific GST compliances centrally, based on their respective GSTINs.

Businesses are currently managing data for multiple states in two separate books of accounts.

Business owners and finance leaders wanted a solution that can save time and increase productivity in their business activities.

Tally Prime Release 3.0 provides businesses with the flexibility to manage their state-specific (multi-GSTIN) data in a single company. With greater simplicity, you can manage all the GSTINs of your branch at once and get instant access to reports that show a comprehensive view of all the GSTINs.

Record Multi GSTIN transactions (GST registered multiple states or branches) at one place Current Situation:

Current SituationThe organization has to maintain separate state wise companies for recording transactions branch wise transactions. The companies fail to get the consolidate view for filing GST returns.

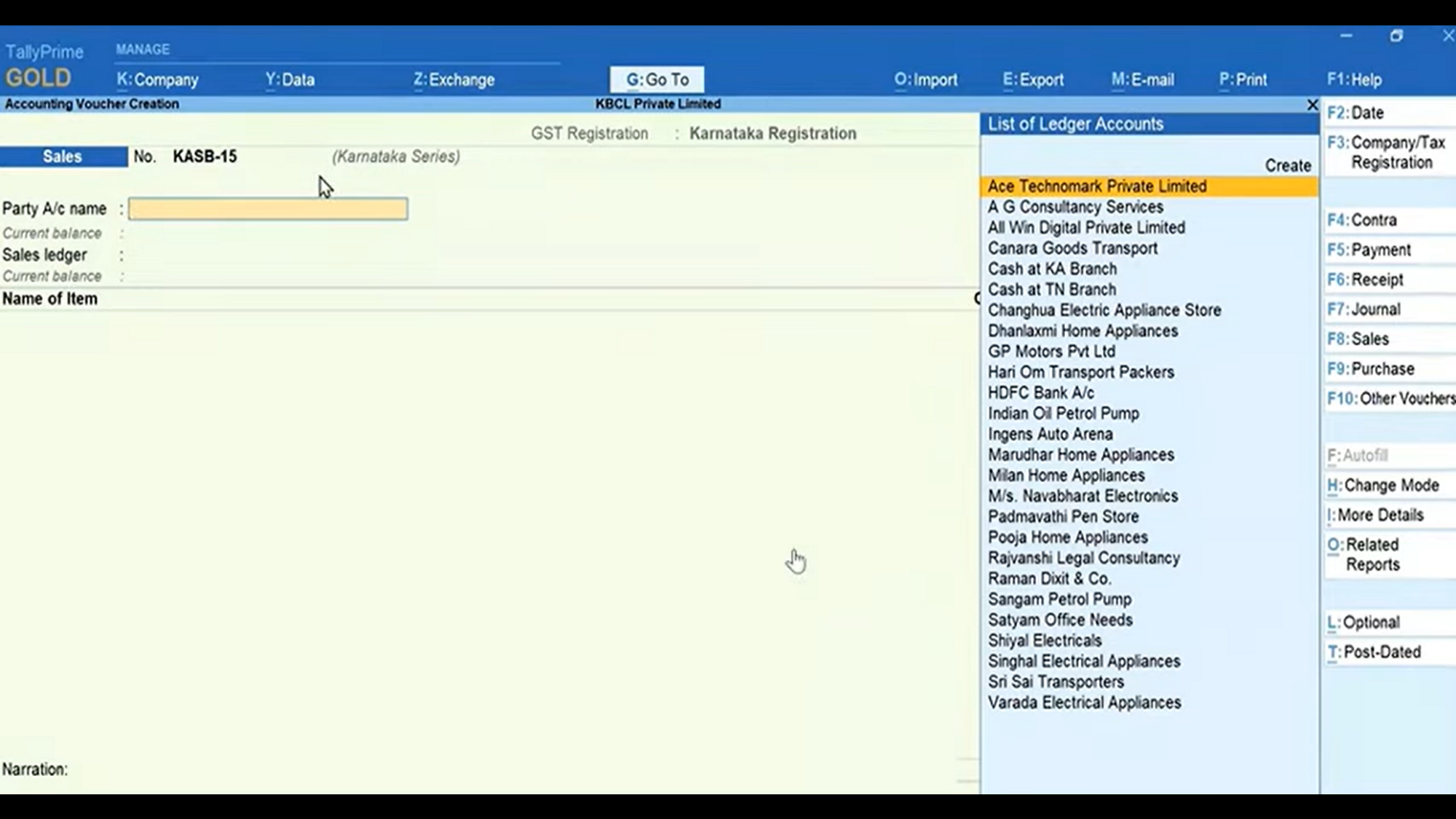

With Tally Prime 3.0, you can record transaction when managing one data for multiple GSTINs. Tally Prime provides the flexibility to manage more than one GST registrations transactions in a single data.

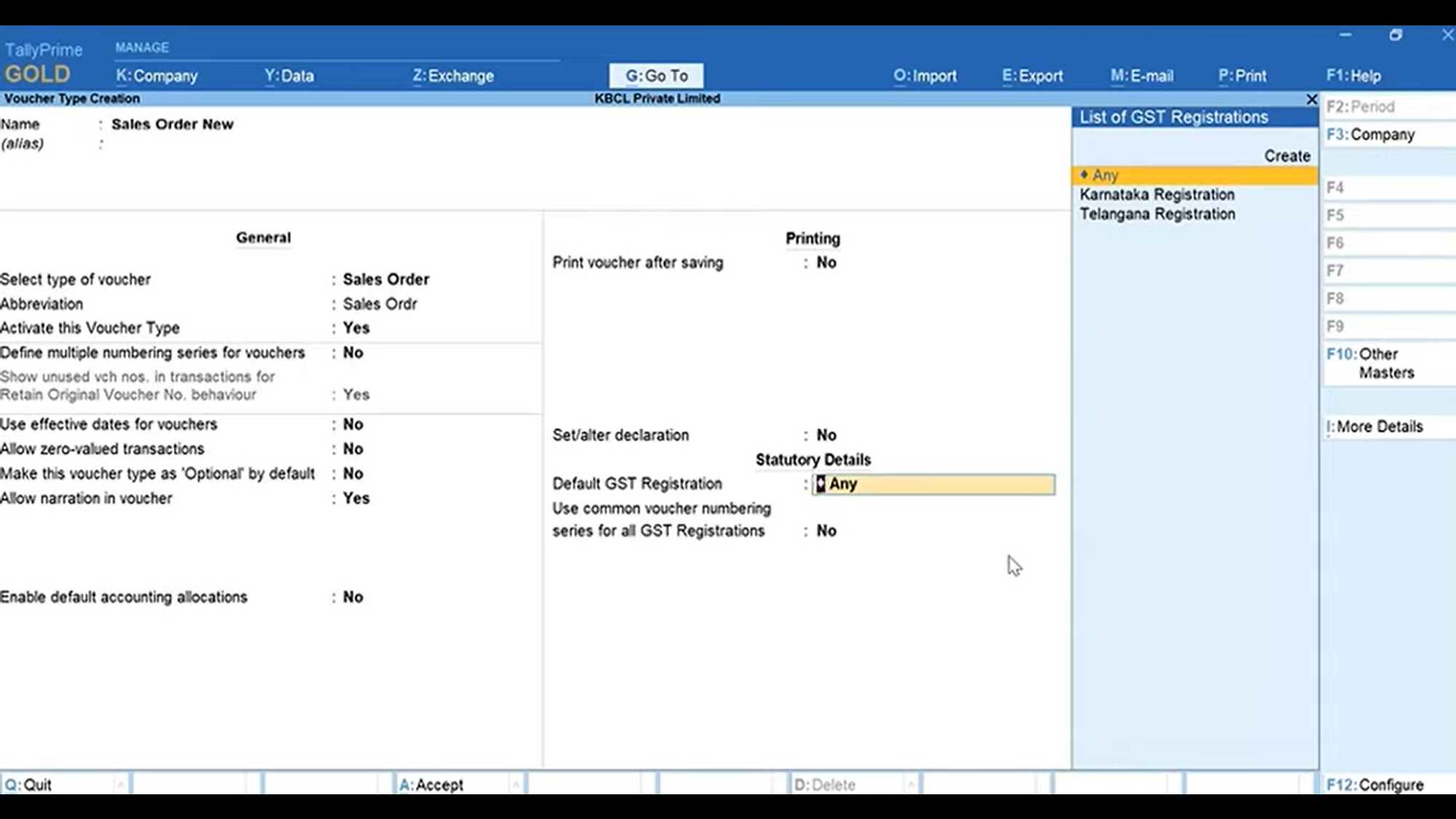

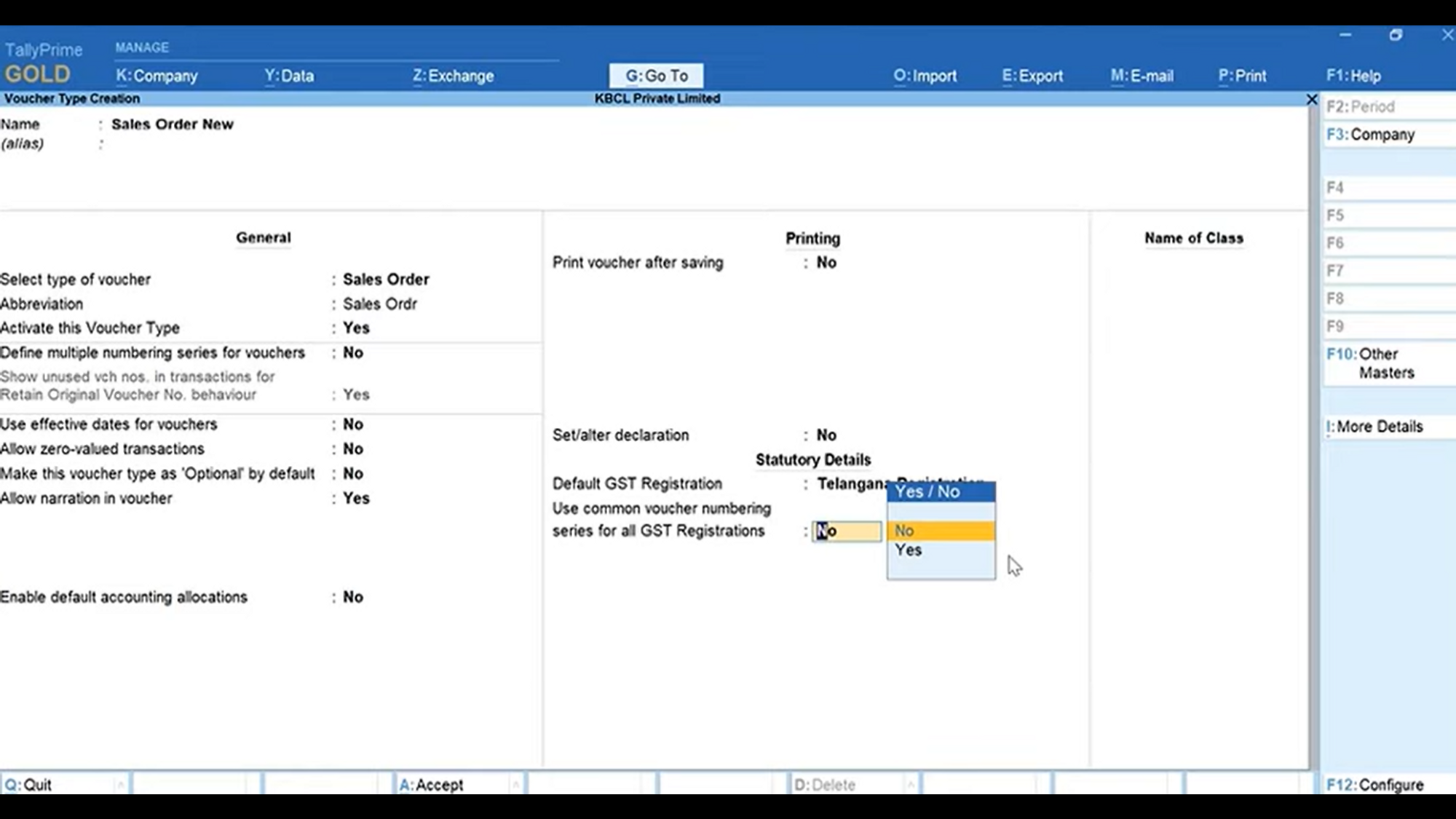

Single voucher can be used to record transaction of multi GSTINs (multiple states) by using function F3: Company / Tax Registration

All type of transactions like sales, purchase, payment etc. can be create from multiple states in one company.

Consolidating data for all the GSTINs (across multiple states) is done manually, which consumes a lot of time and effort. As a result, tax payments may get delayed.

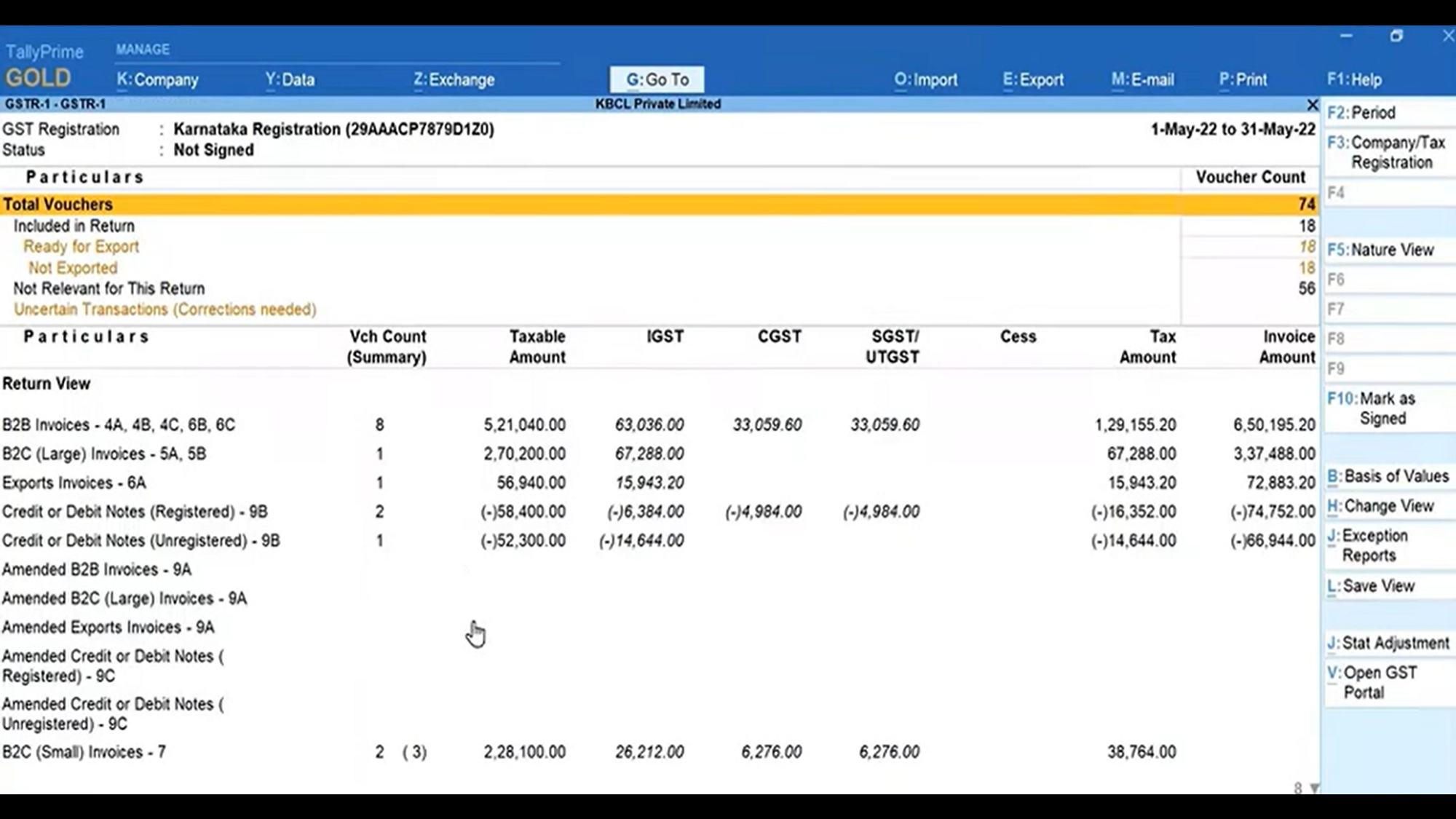

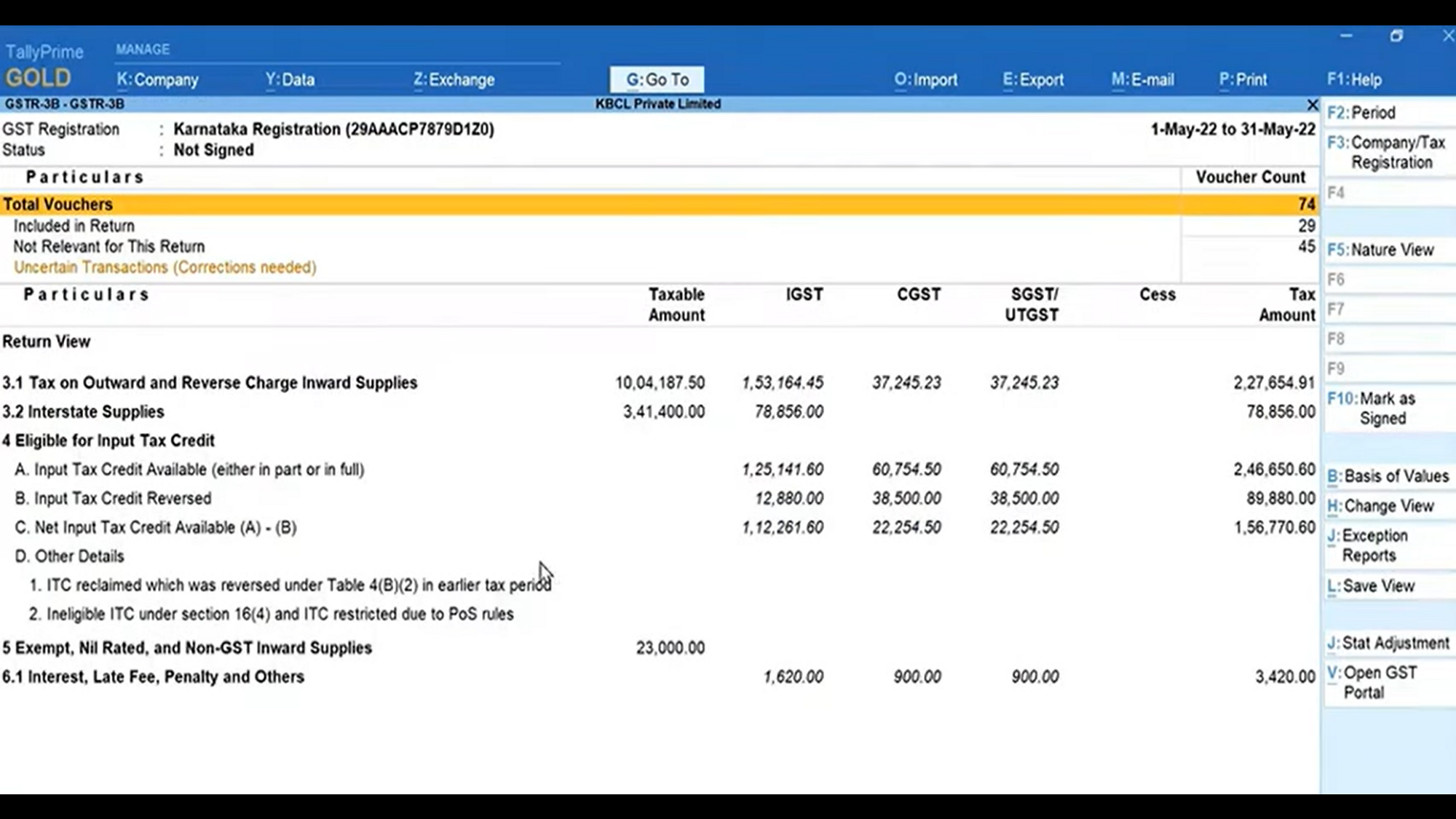

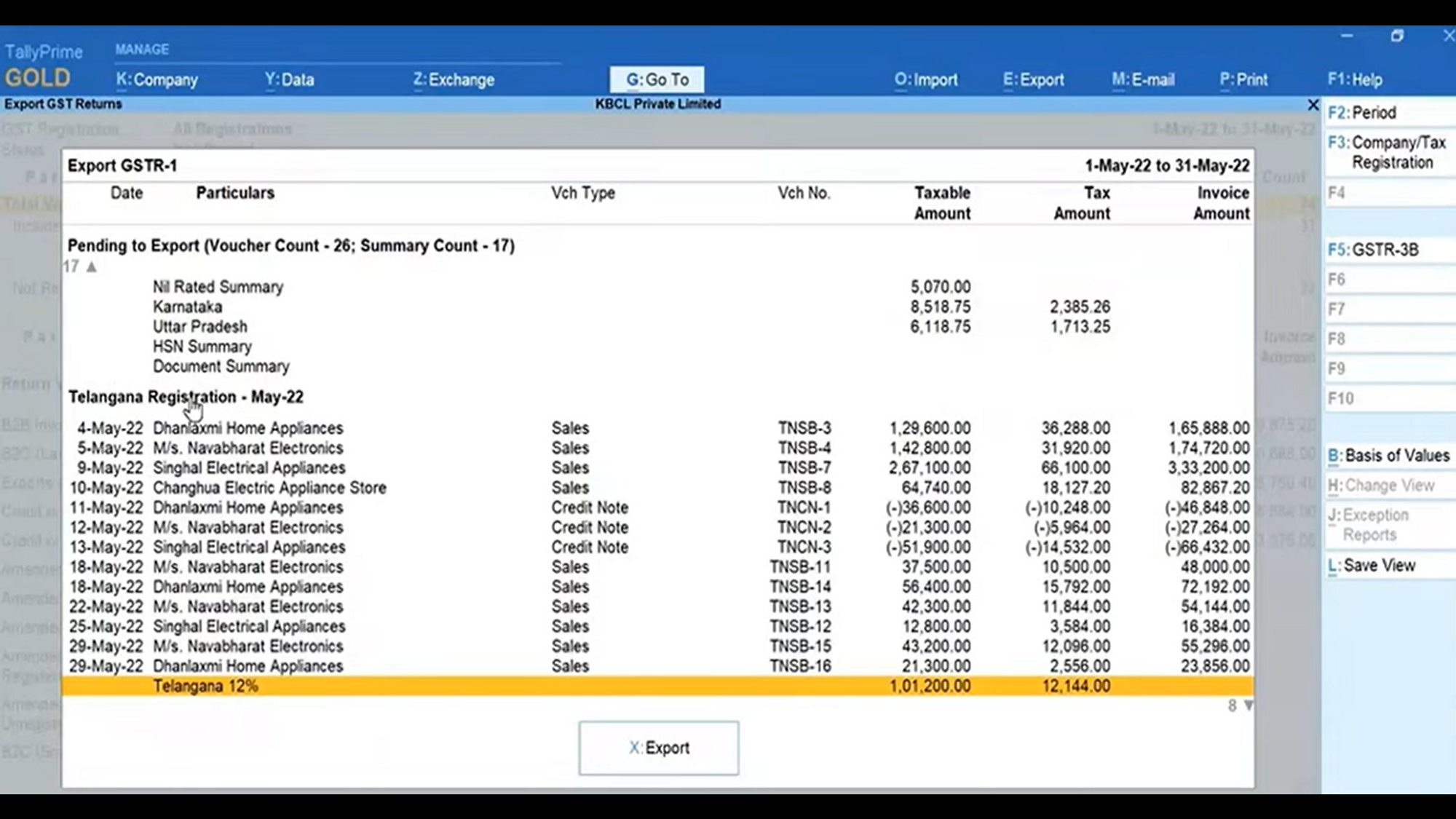

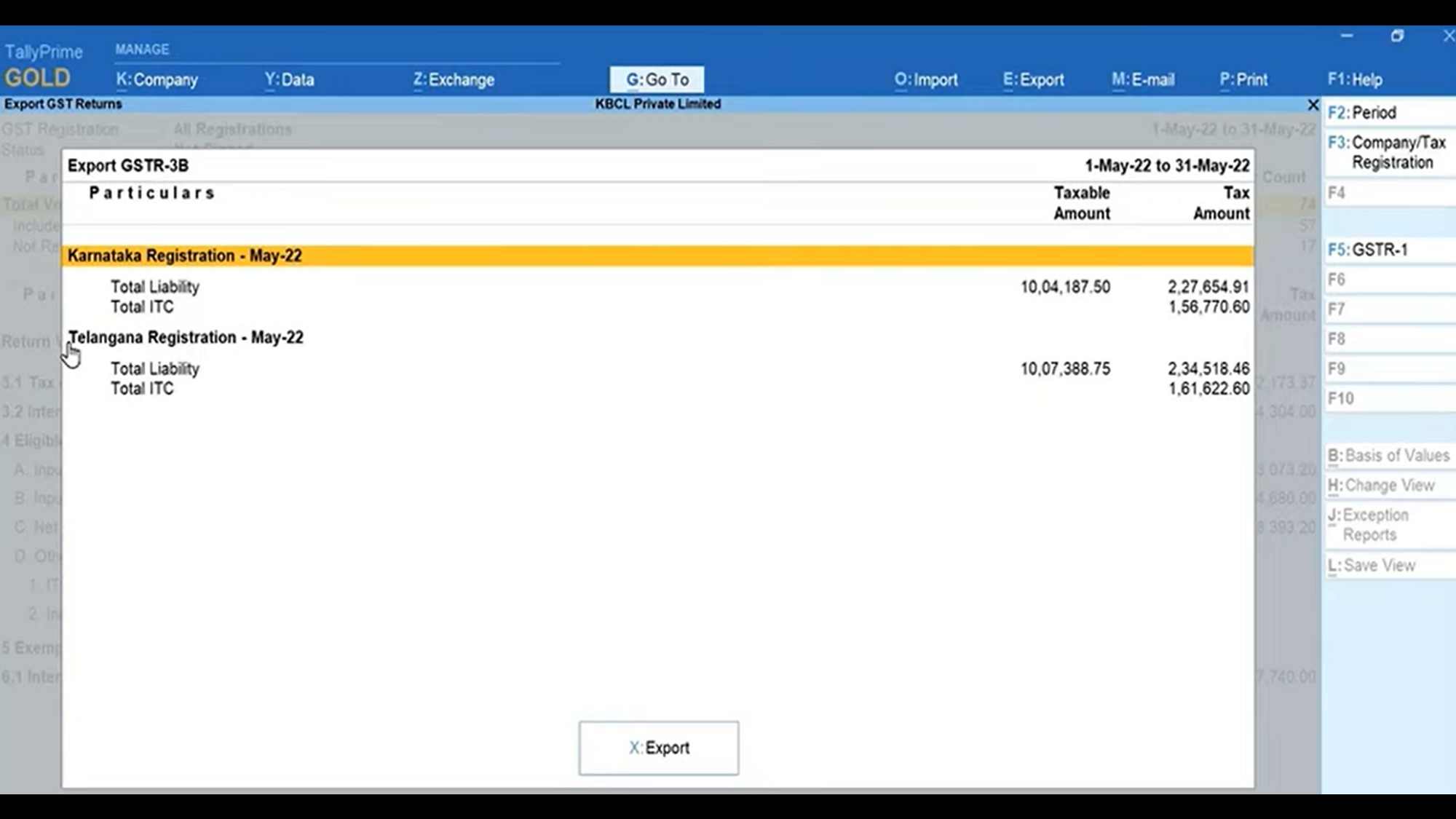

Tally Prime 3.0 makes it easy to manage your returns for all GSTINs or multiple states/branches in one company with greater reliability and simplicity. The GST report, **GSTR1**, shows the consolidated report for all GSTIN registrations. If you want to check for a specific state, you can click on F3: Company / Tax Registration again to see the particular state report separately.

Generate Json file by exporting the GST return branch or state wise for GSTR1

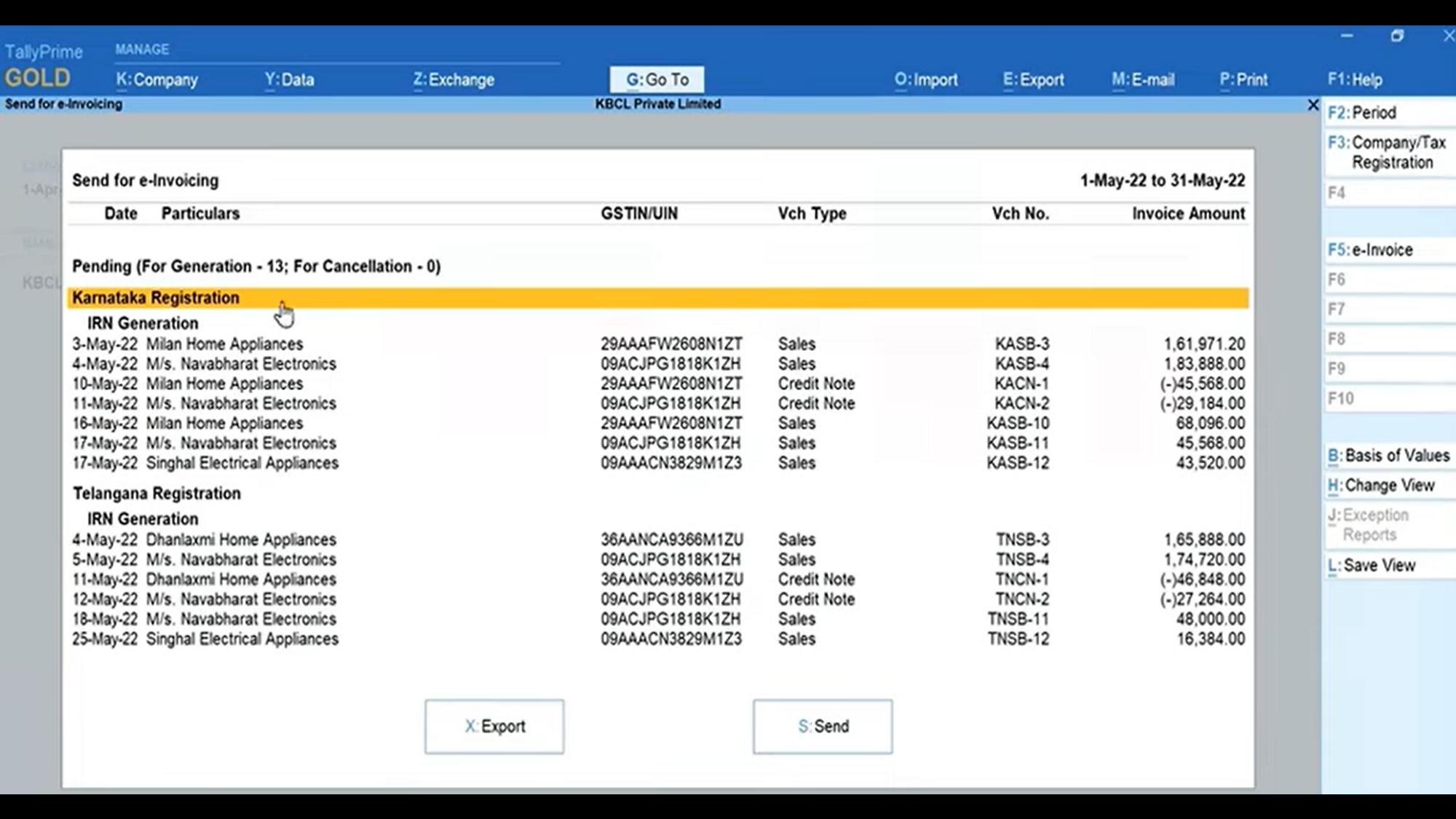

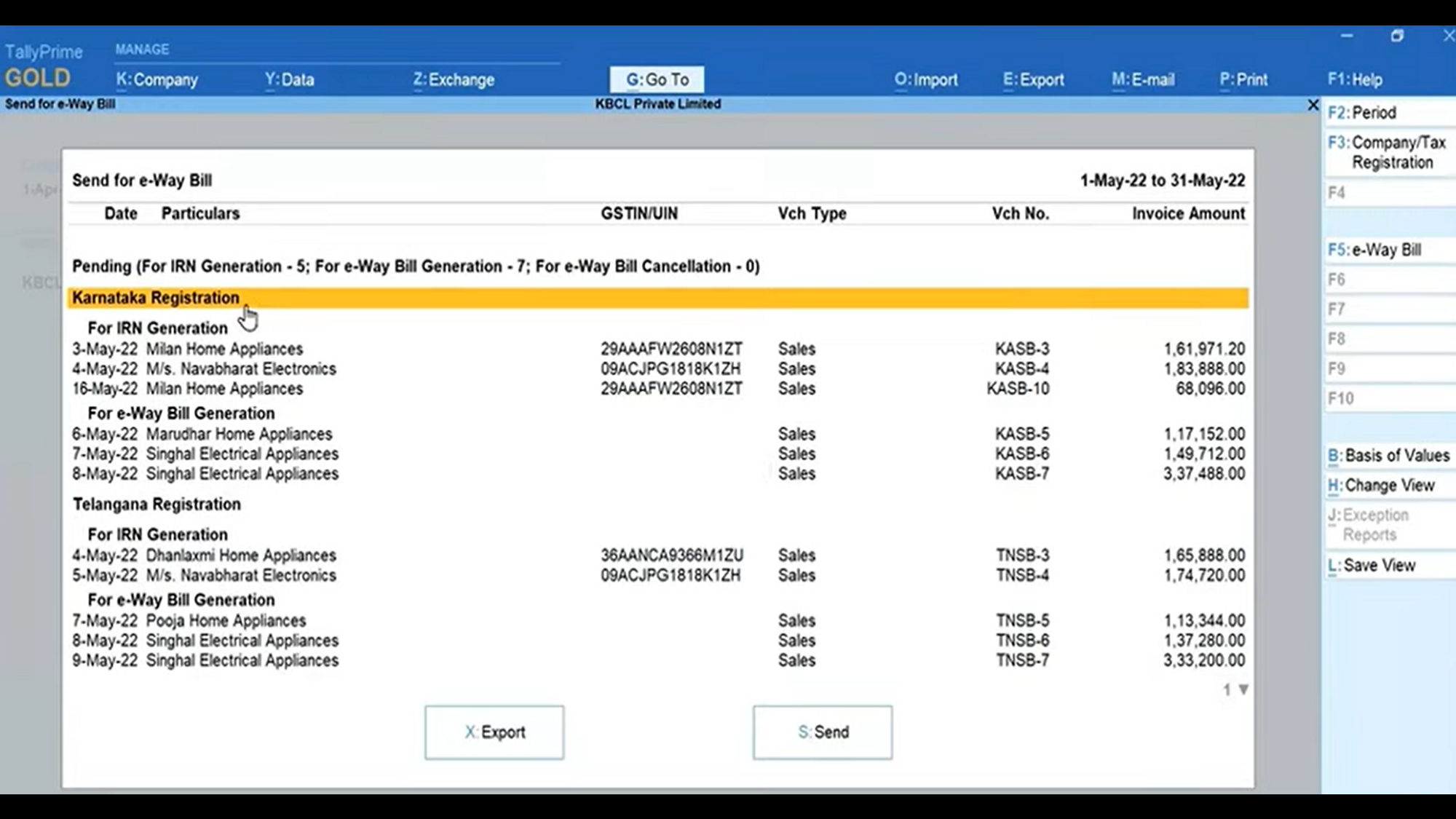

You can generate, export, and send e-invoices for a specific state or for all states (i.e. GSTIN numbers) at once by selecting them from the list of transactions.

Maintaining state/branch data separately impacts efficiency and increases manual work, which can result in human errors. Getting a consolidated view of your financial data and statutory reports also becomes a challenge.

Tally Prime Release 3.0 helps in Multiple GST registrations in a single Company data which brings in a simpler GST Return-filing experience, as you can file GST Return for each GST registration separately using GST reports of a single Company data.

It saves you from the trouble of maintaining different Company data for different GST registrations. This, in turn, saves a great deal of time, as you can work to prepare for GST Returns of each GST registration in a single Company data.

To get access to consolidated financial statements and other MIS reports, for multiple states or branches within a single company contact us here. Our Multi-GSTIN expert will guide you on the process of getting the reports.

Consolidating data for all the GSTINs (across multiple states) is done manually, which consumes a lot of time and effort. As a result, tax payments may get delayed.

Tally Prime 3.0 makes it easy to manage your returns for all GSTINs or multiple states/branches in one company with greater reliability and simplicity. The GST report, **GSTR1**, shows the consolidated report for all GSTIN registrations. If you want to check for a specific state, you can click on F3: Company / Tax Registration again to see the particular state report separately.

Currently, Tally Prime 3.0 does not provide consolidated outstanding for different states and GSTINs but our Multi GSTIN expert can help solve this challenge.